Moscow signs up Kazakhstan, Turkmenistan and Uzbekistan as EU can only look on

In the aftermath of the EU deciding not to renew supplies of energy, and especially gas from Russia, Moscow is building new gas alliances in Central Asia. These are still far from being complete, but the pace of ongoing negotiations indicates that Moscow has managed to get Kazakhstan’s and Uzbekistan’s initial agreement. In this article we look into what these new gas supply trends are and the likely impacts.

The Russia, Kazakh and Uzbek Triumverate

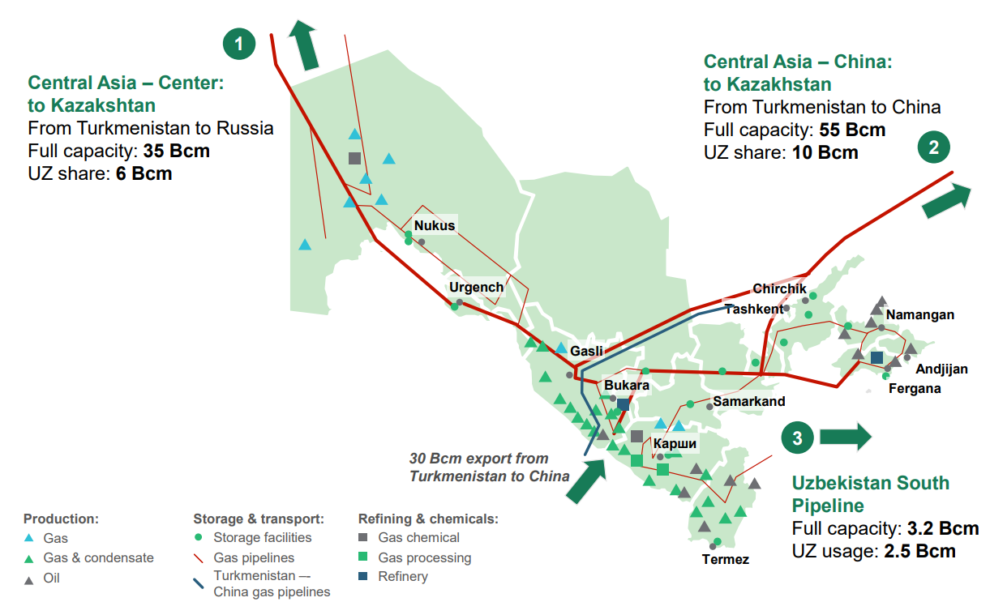

On April 27 this year, Uzbekistan’s energy minister Zhurabek Mirzamakhmudov confirmed plans to supply gas from Russia to Uzbekistan through the Central Asia-Center (CAC) gas pipeline. This is a Gazprom controlled system of natural gas pipelines, which run from Turkmenistan via Uzbekistan and Kazakhstan to Russia.

The eastern branch includes the Central Asia – Center 1, 2, 4 and 5 pipelines, which start from the south-eastern gas fields of Turkmenistan. The western branch consists of the CAC-3 pipeline and a project to build a new parallel Caspian pipeline.

The western branch runs from the Caspian Sea coast of Turkmenistan; with the two meeting in Western Kazakhstan. From there the pipelines run to north where they are connected to the Russian natural gas pipeline system.

Russia and Kazakhstan meanwhile have announced they are negotiating new, lower prices for Russian gas supplies to Kazakhstan. The Kazakh Energy Ministry has said that Astana, Moscow, and Tashkent are discussing the possibility of transiting Russian gas to Uzbekistan. The negotiations are developing; however the potential volumes and terms have not yet been disclosed.

These two statements follow intense diplomatic efforts between Russia and Central Asia in the latest of Moscow’s effort to re-assert its influence in Central Asia amidst the changing of Russia’s pivot to Asia in the wake of EU sanctions.

As Russia’s Western revenues from its gas supplies fell significantly following Western sanctions, Moscow has been aiming at taking advantage of rising opportunities in the faltering energy sector of Kazakhstan and Uzbekistan, Central Asia’s two major players.

This might come as a surprise, as both Kazakhstan and Uzbekistan are already gas-rich countries. Kazakhstan has over 3 trillion cubic meters of reserves, while Uzbekistan possesses 1.8 trillion cubic meters. However, both have underdeveloped infrastructure and are unable to adequately exploit these, meaning this that creates a significant niche for inflows of Russian gas.

For example, during the winter months, large parts of Uzbekistan has gas shortages, the primary reason that Uzbekistan halted its gas exports to China in 2022. Yet Chinese statistics indicate that the country China still imported US$40.1 million worth of Uzbek gas in December 2022.

Similarly, Kazakhstan too had to halt its export to China in late 2022 as domestic consumption took precedence. Over the past two years, the volume of gas exports to China via the Kazakhstan-China gas pipeline has almost halved, from 13 bcm in 2019 to 7.2 bcm in 2021. At the end of 2022, gas exports are expected to be no more than 5.5 bcm. Here too, given the country’s chronically poor infrastructure, Russia has grasped the opportunity by trying to become an additional source of gas for its southern neighbor.

The oil and gas interests of Kazakhstan and Uzbekistan have been closely intertwined with that of Russia. For example, Russian companies has long been supplying oil to China through large enterprises in Kazakhstan, while Kazakh companies have been selling oil to Europe through the Russian port of Novorossiysk. In the gas sector, the connections of the three countries are even stronger since the entire Soviet infrastructure was concentrated for the export of gas to the European part of the USSR and further to Europe for export.

Although the Central Asian states have tried to somewhat distance themselves from Russia following sanctions threats primarily from the EU, there has not been any substitute for Russian gas supplies offered by the EU either, making the threats unwelcome and potentially damaging for Central Asia’s economies. Russia grasped the opportunity over the rising energy crisis in Central Asia in the winter of 2022-2023 and offered to create a gas union with Kazakhstan and Uzbekistan. The natural gas swaps proposed by Putin in late 2022, however, would most likely benefit Moscow. The dominant perception in Central Asia that Russia wants to sell Central Asian gas directly, while also directly exporting its gas to China.

A Cautious Approach

Like Uzbekistan, Kazakhstan too was circumspect about Moscow’s proposal but seemed more cautious. Kazakhstan’s President, Kassym-Jomart Tokayev, signalled in a phone call with Russia’s President Vladimir Putin that the country would be interested to discuss the proposal further.

This initially different reaction from Kazakhstan and Uzbekistan is based on threat perception in Central Asia. If Kazakhstan, which has close relations with Russia within the framework of the EAEU and the CSTO, hesitates between interest in joint oil and gas projects and the fear of falling under secondary Western sanctions, then Uzbekistan, which is not a member of any Russia-led integration projects, is more secure, both politically and geographically. To some extent, Moscow has called the EU’s bluff. Brussels cannot impose secondary sanctions upon Kazakhstan or Uzbekistan without damaging its own gas supplies from these countries, nor risk the resulting political alienation in Central Asia.

After the initial cold reception of the idea of the gas union, Russia nevertheless seems to be moving ahead with the project. For example, Uzbekistan reached an agreement with Russia over potential gas reverse-flow through the Central Asia-Center pipeline with the deliveries to begin in early March this year.

Moreover, in January this year, Gazprom signed two road maps with Uzbekistan and Kazakhstan. Both memorandums are interconnected and imply the joint development of the gas transportation system, both from Russia and among themselves. Among other things, it is planned not only to increase transit export deliveries to China, but also to carry out a total modernization of the transport and distribution system within all three countries.

Turkmenistan – A Central Piece in Moscow’s Vision

Moscow also understands that Kazakhstan and Uzbekistan, when making preparations for the next year, could approach other gas-rich actors such as Turkmenistan. With its own (growing) consumption of 36.7 billion cubic meters, Turkmenistan produces about 84 billion cubic meters of natural gas per year. The main buyer of Turkmen gas is China.

In 2021, Turkmenistan exported about 34 billion m3 of natural gas to China. Taking into account the agreements reached between the two countries and China’s investments in Turkmenistan, as well as China’s massive Belt and Road Initiative (BRI), Turkmen gas has a guaranteed future in the Chinese market. Along with growing natural gas imports to China, exports of Turkmen gas to the country are also on the rise, with the two countries seeking to boost natural gas trade to 65 bcm per year by agreeing to build a fourth gas pipeline from Turkmenistan to China. At the same time, India remains one of the promising, but not yet developed markets for energy resources. No doubt over the coming couple of years, New Delhi could become an influential client state to Russia, Kazakhstan and Uzbekistan.

Over the past 12 years, Beijing and Ashgabat have built three lines of main gas pipelines, through which gas worth US$4.5 billion was exported in 2022 alone. The needs of China are provided by three large deposits in the south of the country – Dovletabad, Iolotan and Bagtyyarlyk. It is from here that gas enters the pipes and is piped east through Uzbekistan, Kazakhstan, and Kyrgyzstan.

Turkmenistan is among the top five countries in terms of natural gas reserves, amounting to about 20 trillion m3. More than 40 gas fields are being developed in Turkmenistan, including significant fields at Galkynysh , Bagadzha, Gazlydepe, Garabil, Garashsyzlygyn, Gurrukbil, Dovletabad, and Zeakli-Dervaza.

The Turkmen SOE “Turkmengas” is one of the largest energy companies in the world, whose activities cover areas such as exploration, production, processing and export of natural gas. At the end of 2021, natural gas production in Turkmenistan amounted to 79.3 billion m3.

The development and production of gas in the offshore fields of the Caspian Sea is carried out by foreign companies (mostly by China’s CNPC, and Malaysia’s Petronas) under the terms of a production sharing agreement.

Natural gas consumption in Turkmenistan in 2021 amounted to 36.7 billion m3, the growth in demand being due to the commissioning of new gas turbine power plants and gas processing complexes, including a polymer plant in Kiyanly, a plant for the production of carbamide fertilizers in Garabogaz and plant for the production of synthetic gasoline in the Akhal Velayat region.

Using traditional routes, Turkmenistan has implemented a number of major projects to bring its energy resources to world markets: the “Turkmenistan - China” gas pipeline and the second branch of the “Turkmenistan - Iran” gas pipeline. In addition, another major energy project, the construction of the gas pipeline “Turkmenistan - Afghanistan - Pakistan - India” ( TAPI) is also under implementation.

Ashgabat’s main goals of the activity are the increase in oil and gas condensate reserves and the discovery of new fields, with the planned volume of drilling work being 28,000 m per year. According to the State Corporation “Turkmengeology”, 38 oil and 82 gas condensate fields are currently in Turkmenistan.

More than 30 fields are under development, the largest of them are Goturdepe, Barsagelmes, Cheleken block, Kumdag, Korpeje, Makhtumkuli, Okarem and Nebitdag block, as well as giant oil and gas fields – Galkynysh, South Iolotan. The main volume of oil production in the country is provided by the Turkmennebit State Concern (Türkmennebit döwlet konserni, Turkmenneft), which amounted to 8.9 million tons in 2021.

Accordingly, Turkmenistan plays a major role in Russia’s energy strategy in Central Asia. A delegation of the Russian State Duma led by speaker Vyacheslav Volodin arrived in late January this year in Ashgabat, where numerous meetings at the highest level were held. It was agreed that Moscow and Ashgabat plan to coordinate their actions as closely as possible so as not only to benefit, but also not to harm the other side.

Later in February, Gazprom chief Aleksei Miller also visited Ashgabat. No official information was released as to the details of the bilateral talks, but it fair to say that this visit was about ensuring Turkmenistan would not be going against Russian plans to keep its dominant position in the region’s gas sector.

Russia’s plan to maintain a central role Central Asia gas market as well as infrastructure falls within Moscow’s greater ambition to retain its influence in its immediate neighborhood, especially amid the sanctions imposed by the West and especially the EU. But to do so, Moscow will have to make increasing concessions to both Astana and Tashkent. Lower gas prices are one of them, while another could be Moscow’s hesitant acceptance of any increased foreign policy autonomy of the two Central Asian states.

In other words, Astana and Tashkent are testing Moscow’s resolve and aim at achieving greater space maneuvering, while in return, Russia through discounts and concessions in other political areas is likely to achieve Astana’s and Tashkent’s tacit agreement on closer cooperation with Moscow in the energy sector. If so, the EU will have been outmaneuvered as concerns its attempts to stymie Russian gas flows.

Source: Russia Briefing